112 x A x B. It sets out the interpretation of the Director General in respect of the particular tax law and the policy as well as the procedure applicable to it.

2022 Tax Plan Outline Of Corporate Income Tax And Dividend Witholding Tax

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

. Funds the Company shall be receive deemed interest from such loans or advances for that basis period and. Additionally where interest is paid to a non-resident the interest derived or deemed derived from Malaysia is subject to withholding provisions. 22 May 2009 Issue.

Effective from YA 2014 it is proposed that a Company is deemed to have gross income consisting of interest from loan or advances to directors. The interest income taxable is calculated on a monthly basis with the formula below. 32016 Date of Publication.

Refer to Paragraph 52 of the PR. The interest income is calculated based on the formula -. Public Ruling No92015 Date of Publication.

62015 dated 27 August 2015. A refers to the outstanding director loan amount at the end of the calendar month. 16 May 2016 SYARIKAT.

The interest income for that basis period shall be the aggregate sum of monthly interest in that basis period. 32 Real property includes any land and any interest option or other right in or. It sets out the interpretation of the Director General in respect of the particular tax law and the policy as well as the procedure applicable to it.

Treatment of interest expense attributable to dividend income received by a company 19 - 21 12. General deductibility s331. Loan or Advances to Director by a Company PR No.

Public Rulings Public Ruling PR No. 3 December 2015 Page 1 of 21 1. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

This Ruling explains the basis of determining gross income for the purpose of computing adjusted income derived from the business of construction contracts. I a company that provides loans or advances to a director of the company without interest or with interest rate lower than the arms length rate. The IRS will monitor organizations public charity status after the first five years based on the public support information reported annually on Schedule A PDF which is attached to Form 990 Return of Organization Exempt From Income Tax PDFAfter an organizations initial five years its public support test is based on a five-year computation period that consists of.

122014 dated 31122014 and No. A is the total amount of loan or advances outstanding at the end of the calendar month. INLAND REVENUE BOARD MALAYSIA Public Ruling No.

The sum of the monthly interest is determined. The Director General may withdraw this Public Ruling either wholly or in part by. The Director General may withdraw this Public Ruling either wholly or in part by.

A when a deduction is allowed in respect of interest expense in computing the. Monthly Interest Income taxable 112 x A x B. 82015 was published by the IRB on 30 November 2015 to explain the tax treatment of.

B Page 1 of 27 1. C Mortgages and loans are normally private contracts between a lender. Commenced prior to 1 January 2014 the deemed interest income under Section 140B is to be computed only on loans or advances outstanding from 1 January 2014 onwards.

Deferred payment credit 19 11. INLAND REVENUE BOARD OF MALAYSIA Public Ruling TAX TREATMENT ON INTEREST INCOME RECEIVED BY A PERSON CARRYING ON A BUSINESS No. Effective date 21 DIRECTOR GENERALS PUBLIC RULING A Public Ruling as provided for under section 138A of the Income Tax Act 1967.

The Income Tax Act 1967 ITA related to this Public Ruling PR are sections 2 and 140B subsections 21A8 293 75A2 and 1402 and paragraph 4c. New Public Ruling 92015. Further to the introduction of Section 4B the Inland Revenue Board of Malaysia IRBM has issued Public Ruling PR 32016 on Tax Treatment on Interest Income Received by a Person Carrying on a Business which provided explanation on the tax treatment in respect of interest income received by a person carrying on a business.

Interest expense incurred on investments 8 - 17 9. Superceded by Public Ruling No. Public Ruling 9 of 2015 provides clarifications regarding both interest income and interest expense.

22009 Date of Issue. Objective The objective of this Public Ruling PR is to explain in relation to a loan transaction between related persons. 41 Letting of real property is deemed as a business source and the income received.

A failure to comply will lead to punitive penalties. Company that provides loan or advances to directors from its internal funds shall be deemed to derived interest income which is assessable under Section 4 c of Income Tax Act 1967 ITA. B refers to Average.

A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is. Interest source income is deemed to commence on the date it first accrued. Deduction of Interest Expense And Recognition of Interest Income For Loan Transactions Between Related Persons.

Refinancing loan 17 - 18 10.

Netherlands Will Repay Up To 11 7 Billion For Unlawful Taxes On Savings And Assets Nl Times

Tax Credits In The Dutch Payroll Administration Expatax

Intermarriage Has Increased Steadily Since The 1967 Loving V Virginia Ruling Here Are More Key Findings Abou Marriage Funny Dating Quotes Marriage And Family

Kremlin As Expected Rejects Icj Ruling To Halt Ukraine Invasion

Requirements For The 30 Ruling For Expats In The Netherlands

Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq

2022 Tax Plan Preventing Mismatches When Applying Arm S Length Principle Pwc Tax News

The State Of Evolution In The Classroom Proud That Florida Is One Of The Four It Should Be Taught Every Where Evolution Education Evolution Science Curriculum

July 1952 Fotomatic The First Originial In July 1952 A Complaint Was Brought Against Morse And Mercury With A Ruling Manufacturing Plant Brand Names Words

Archillect On Twitter Street Art Graffiti Artwork Graffiti

How Google Determined Our Right To Be Forgotten Julia Powles And Enrique Chaparro The Guardian

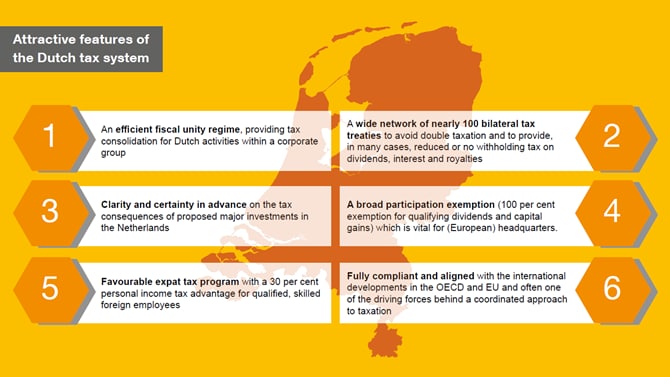

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

What Is The 30 Percent Ruling Taxation In The Netherlands

Dutch Government Claimed Too Much Tax On Citizens Savings Supreme Court Nl Times